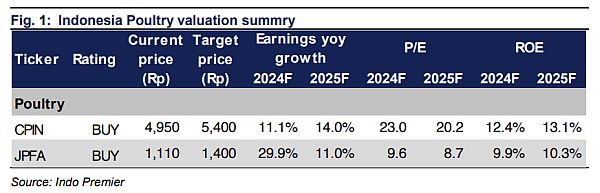

Sector Update / Poultry / Click here for full PDF version

Author(s): Andrianto Saputra ;Lukito Supriadi

- We expect stellar poultry 1Q24F earnings at 28% of ours' FY24F estimate (vs. 4Q23 net loss) on the back of strong 1Q24 broiler price (+10.3% qoq/+16.3% yoy).

- Feed costs expected to normalize on corn harvest seasonality after 1Q24 corn price spike.

- Higher US$ imply higher costs in imported SBM but is typically pass through. Maintain Overweight on expectations of earnings turnaround.

Much stronger broiler/DOC price on yoy basis

Average FY24 fasting month-Eid (12Mar-10Apr24) broiler price stood at Rp22.0k, +20.5% yoy from FY23. We view the broiler price strength is demand-driven as government did not implement culling since Nov23. This led to higher average 1Q24 broiler price of Rp19.9k/kg (+10.3% qoq/+16.3% yoy), along with improved average 1Q24 DOC price's Rp5.1k/chick (+49.6% qoq/+109.1% yoy). As of 23Apr24 (post Eid), broiler price has normalized to Rp19.1k/kg, a -14.5% drop from Eid period (vs. -16.8% in FY23's). We estimate broiler price is likely to sustain at Rp19k/kg as current broiler cold storage utilization rate has declined substantially from end of FY23, based on our channel checks and this also reflected on the recent DOC price trend of Rp6.5k/chick in 23Apr24 (Fig. 3).

Feed cost inputs to normalize after 1Q24 spike in corn prices

Average 1Q24 corn price rose to Rp6.5k/kg (+12.6% qoq/+47.9% yoy) as the rising corn price was due to prolonged El Nino in FY23. However, average 1Q24 soybean meal decreased to US$348.5/Mt (-17.3% qoq/-28.0% yoy), this will increase the substitution viability. Taking into account strong 1Q24 broiler & DOC price and 1Q24 input cost, we estimate CPIN /JPFA to book 1Q24F net profit at Rp802/620bn (vs. 4Q23's net loss of -Rp357/-8bn) and 1Q24F result will be above our at 23/42% and consensus estimates (at 23/50%). As of 23Apr24, corn price has normalized to Rp4.8k/kg due to successful corn harvest in Apr24. Based on our channel check, corn price normalization is likely to sustain until May24 due to big corn harvest.

Higher US$ imply higher costs in SBM but is typically passed on

With the concern on Rupiah depreciation against US$, we analysed CPIN and JPFA ' US$ exposure on its cost (mostly soybean meal, vitamin premix, mineral premix, etc.) (Fig. 8). However, US$ appreciation impact has 2-3 months lag accounting for SBM inventory buffer for both CPIN and JPFA . Assuming all else being equal, our sensitivity analysis shows that every 1% Rupiah depreciation against US$ may impact FY24F CPIN /JPFA core earnings by -4.7/-9.0%, ceteris paribus. It is worth highlighting that feed segment is a cost plus business; hence, the company shall pass on the higher input cost.

Maintain OW for the sector

We maintain Overweight on the sector as normalization input costs (corn price) is sustainable in near term and shall be key tailwinds for the sector. Downside risk: rising input cost, prolonged US$ appreciation and soft broiler price post Eid festive.

Sumber : IPS